Learn practical skills in Finance and Accounting

Individual and Small Business Courses

Do you want to improve your financial knowledge and learn advanced skills?

Or do you want to gain practical accounting skills and be ready for the workforce?

We are here for you! Our courses will give you the skills you want to achieve.

We offer tax accounting course, Xero payroll course, Xero courses for beginners, cash flow course, finance and bookkeeping courses, and more.

Why us

Available in person or online

Flexible schedule (weekdays or weekends)

Suitable for business owners, managers, individuals, and graduates

Financial support available through RBP funding from Auckland Unlimited

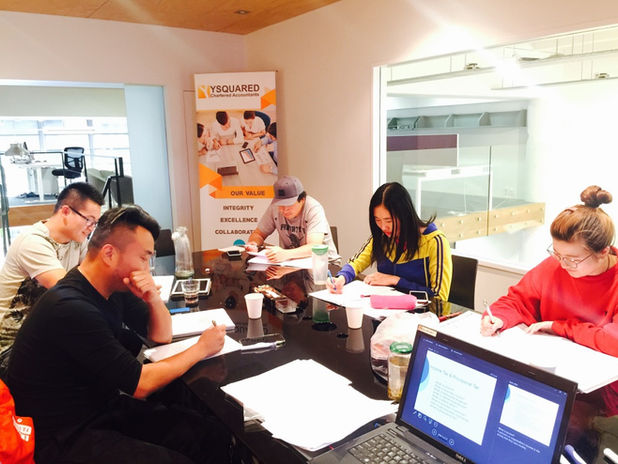

Our classes and students

PAYE & Xero Payroll

-

Explain types of employees

-

Annual leave, sick leave, bereavement leave and parental leave entitlements

-

Deductions

-

Employee time recording, pay adjustments

-

Annual leave and holiday pay

-

Dealing with KiwiSaver and employer superannuation schemes

-

Inland revenue penalties

-

Setting up Xero Payroll

-

Creating payroll and PAYE returns for Inland Revenue on Xero

MPA Foundation Course

80 hours of learning:

-

Fringe Benefit Tax (FBT)

-

GST Essential

-

Xero Essential

-

Xero GST

-

Manual Journals

-

Fix Asset Register

-

Year End Workpaper

-

Xero Financial Report

-

Individual Income Tax Return

-

Rental Property

-

On the job training at CA firm (60 hours)

-

CV and interview training workshop

Job Ready Programme for Student

88 hours of learning:

-

Fringe Benefit Tax (FBT)

-

GST Essential

-

Xero Essential

-

Xero GST

-

KiwiSaver

-

Employment types

-

Employment Leaves

-

Xero Payroll

-

Manual Journals

-

Fix Asset Register

-

Year End Workpaper

-

Xero Financial Report

-

Individual Income Tax Return

-

Rental Property

-

On the job training at CA firm (60 hours)

-

CV and interview training workshop